Entropay Alternative

There are more than 25 alternatives to Entropay, not only websites but also apps for a variety of platforms, including Android, iPhone, Windows and iPad. The best alternative is PayPal. It's not free, so if you're looking for a free alternative, you could try Amazon Pay or Skrill. Entropay charges a 2% currency exchange fee. The solution to this is to have the poker room convert the funds before paying a withdrawal. Entropay Alternatives. Players that do not like the fees or withdrawal methods for Entropay may want to consider other options. These include depositing with a Visa or Mastercard directly to the poker site.

- Entropay Alternative Us

- Entropay Customer Service Phone Number

- Entropay Virtual Card

- Entropay Alternative Australia

Entropay is an excellent alternative to online eWallets such as Skrill, Neteller and PaySafeCard. Previous abuses and historical fraud associated with these payment methods have led to many online bookies removing their sign up bonuses for customers who sign up that way. EntroPay is an online account that gives users a safe method to pay wherever VISA is accepted, using a prepaid EntroPay Virtual VISA card that works like any other VISA debit card. EntroPay gives users a fast and easy method to transfer money and pay for items at millions of merchants worldwide. Entropay is a wholly-owned subsidiary of Ixaris Group Holdings Limited. Entropay is registered in England and Wales, with company number 04072405 and registered office at 2 Stephen Street, London, W1T 1AN.

PayPal is one of the original, and still de-facto e-money provider that allows you to send and receive funds at the click of the button.

If you’re based in the UK and you transfer money to friends or family that are also in the UK, then you won’t pay any fees to transact. This is also the case if you decide to withdraw funds to a UK bank account, as the process is free.

However, sending and receiving funds to somebody located abroad can be costly, as the fees PayPal charges for such a privilege are somewhat expensive.

It is also important to remember that not all online vendors favor PayPal as their primary e-money payment provider. As businesses themselves get charged fees to accept payments via PayPal, alternatives such as Skrill and Google Wallet are becoming more and more popular.

As such, if you’re looking for the best PayPal alternatives, be sure to read our guide. We’ll explain how each e-money provider works, alongside their respective advantages and disadvantages.

Skrill

Contents

Formally known as MoneyBookers, Skrill is by far the most popular alternative to PayPal. The UK company behind Skrill first launched its e-money service way back in 2001, making them one of the most established online payment processors in the industry.

The main overarching concept of Skrill is virtually identical to that of PayPal. Users create an account, link up a payment method such as a debit/credit card or bank account, deposit funds, and subsequently, send money.

Before you can start using your newly created Skrill account, you’ll first need to verify your identity. Much like in the case of PayPal, you might need to upload a copy of your government issued ID, and confirm a telephone number and email address.

In terms of fees, this can vary depending on where you are based. However, in the UK you will pay a 1% deposit fee when uploading funds to your Skrill account, and a fixed fee of EUR 5.50 (UK equivalent) if you decide to withdraw funds back to your UK bank account.

If you decide to withdraw money back to your VISA debit card, you’ll pay a remarkable 7.5% in fees. Skrill will also charge you a 1.45% transaction fee when sending funds to another user, although receiving money is free. All in, the fees charged by Skrill are significantly higher than that of PayPal.

Read our full review of Skrill.

TransferWise

If you’re looking to send and receive money overseas, or you’re looking to transact in more than one currency, then TransferWise is potentially the best option for you.

For example, while multi-currency transfers via PayPal can cost anywhere between 3-11.4%, TransferWise averages about 0.5% for most major currencies.

TransferWise is also notable if you want to send or receive money to a bank account. Although the payment provider acts as a third party intermediary between the two banks, the process is nothing short of excellent.

In most cases, transfers are received in less than an hour, with the receiver paying very little in terms of fees. This makes it ideal if you work as a freelancer and you need your international clients to pay you in the fastest and cheapest way possible.

Read our complete Transferwise Review

Google Pay

Google Wallet is an alternative to PayPal that allows you to seamlessly send and receive funds via your mobile phone. One of the stand-out advantages of Google Pay is that the provider does not charge you to fund transactions with a debit or credit card, nor does it cost anything to deposit via a bank account.

This makes Google Wallet stand out from the likes of Skrill or PayPal, who are both known to charge excessive fees.

Users of Google Wallet can also have a physical pre-paid card sent to them. This allows you to use your Google Wallet balance to pay for goods and services in-store, or even withdraw cash from an ATM.

The only down-side to the Google Wallet app is that significantly fewer merchants accept it in comparison to PayPal, and even Skrill. However, as Google Wallet is much more favorable for online stores, at least in terms of fees, expect the provider’s market share to increase over time.

Finally, although Google Wallet is a direct competitor to the Apple Pay e-money service, iOS users can still download the app via the iTunes Store.

Neteller

Originally based in Canada before relocating to the Isle of Man in 2004, Neteller is an e-money provider that performs a similar function to both PayPal and Skrill. The provider has excellent exposure in the online marketplace, meaning that you have plenty of choice if you’re looking to use your Neteller funds to buy products or services.

Neteller allows you to fund your account with several different payment methods. This covers popular payment channels such as Visa and Mastercard, as well as unconventional methods such as Bitcoin and GiroPay.

Most funding methods carry a deposit fee of 2.5%, which is quite expensive. If you want to withdraw your money out of Neteller, you’ll pay a $10 fee if opting for a bank transfer.

Although using your Neteller balance to buy goods online is free, money transfers cost 1.45% per transaction, plus a fixed fee of $0.50. If you need to transact in more than one currency, then you’ll need to pay an additional 3.99%.

This can make cross-border transactions very expensive, especially when you add on the standard transaction fee of 1.45%

Entropay

If your main objective is purchase goods and services online without exposing your debit or credit card details, then Entropay is one the best PayPal alternatives out there. In the nutshell, the Maltese-based company allows you to create an unlimited number of virtual credit cards (VCCs). The name VCC can be somewhat misleading, as they are actually pre-paid debit cards as opposed to credit cards.

Nevertheless, once you register an account and verify your identity, you’ll be able to use your personal debit/credit card or bank account to deposit funds. The only issue with Entropay is that you’ll need to cover a rather hefty 4.95% deposit fee when you upload funds.

However, once you’ve loaded your account, you can create a new VCC and subsequently use it in the same way that you would a traditional bank card. The cards are backed by the Bank of Valletta, and issued by MasterCard.

Payoneer

Launched in 2005 and headquartered in New York, Payoneer is a payment services provider that allows users to send and receive money online. The platform currently services more than 4 million customers located in more 200 countries.

When it comes to fees, Payoneer charge 1% to upload funds to your account, which is a lot cheaper than many of the other PayPal alternatives on our list. The good news is that if you use Payoneer to transfer funds to a bank account, you pay nothing apart from the fees charged by the receiving bank.

Cross-currency transactions cost in the region of 2% above the mid-market rate, although this can be lowered if you hold a VIP account. If you obtain the Payoneer pre-paid debit card, then you’ll pay $3.15 per ATM withdrawal.

Payoneer is also a notable PayPal alternative due to its highly rated customer support. You have the option of contacting support via telephone, live chat or through a support ticket. However, response times are somewhat slow over the weekend, so you’re best off calling them if your query is of an urgent nature.

Venmo

Venmo was launched in 2009 and is owned by PayPal. The online payment provider adds a personal touch to transactions, which makes is great if you want to send or receive money to friends and family. The great thing about using Venmo is that you won’t be charged to upload funds via a bank account.

However, if you want to transact using your credit card, you will pay a 3% fee. This is standard for most credit card deposits in the e-money space, as providers cover their backs in the case of a charge-back.

Although Venmo is great for its fast transactions and reasonable fees, it’s not really suitable for freelance payments or supplier invoices as the app is intended for transferring cash between family and friends.

Best PayPal Alternatives: The Verdict?

In summary, although PayPal is one of the most popular e-money providers in the industry, there are some highly notable alternatives to consider. The PayPal alternative that you go with will ultimately depend on what you are looking for from an e-money provider.

For example, if you’re looking to regularly send and receive funds on an international basis using multiple currencies, then your best bet is likely to be TransferWise. Alternatively, if you want an e-money provider that charges the lowest fees, then Google Wallet is probably the most suitable, not least because they do not charge anything to transact.

Whichever PayPal alternative you do decide to use, just make sure that you have a full understanding of the underlying fee structure. Certain fees, such as account inactivity charges, are often not clearly stated, so ensure you do lots of research before signing up.

Entropay was effectively a pre-paid virtual VISA card until it was closed down in 2019. It had been going since the turn of the millennium and was widely accepted by betting sites in the UK and Europe.

When Entropay initially created virtual cards it was a novel thing, however in modern times many companies now offer virtual VISA and MasterCard services that made them largely defunct. You can get virtual cards from a range of sources now that can be used to load and withdraw funds from bookmaker sites, these include Skrill & Neteller. They parent company behind Entropay, Ixaris, still offer virtual card services too.

The virtual card system has several distinct advantages, as it is pre-paid it cannot be overdrawn, it avoids any fees associated with credit cards, doesn't require a credit check and is more secure than sharing your bank details direct. Virtual cards also have the advantage over services such as Skrill and Netller directly in that almost all welcome bonuses from the sites listed here are available.

- Entropay:

Entropay Now Closed - Alternatives Available

When Entropay started life it offered a unique product, a pre-paid VISA card that could be used to add funds to betting sites. This system was particularly useful for those that like to track and control their gambling spending separately to their main bank account.

These days, however, you can now get real or virtual cards linked to many different financial services provides. Skrill and Neteller, for example, have cards that can be linked to your eWallet account allowing you to spend directly from those accounts without needing to go through a bank. There are also a multitude of other providers out there that now provide pre-paid card services.

The beauty of using these linked cards is you can use them at any site that accepts VISA and MasterCard, which you can find below.

About Entropay

Entropay was the first virtual pre-paid card available in Europe and is aimed mainly at the security conscious amongst us who want to be able to fund online accounts without sharing bank details directly. The system also ensures you only spend what you pre-load into your entropay account preventing the problem of going overdrawn.

Ixaris Systems ltd is the name of company that owns the entropay brand. They are fully licenced and regulated by the Financial Conduct Authority (FCA), registered at 10 Midford Place, London, W1T 5AE, United Kingdom. The VISA cards themselves are issued and guaranteed by the Bank of Valletta, Transact Payments Limited and IDT Financial Services Ltd, in Malta, licenced by VISA Europe.

Basically this is a very open, honest and simple system and perfect for any punter who wants to set funds aside to gamble with in a very safe and secure manner.

entropay Gambling

Entropay Alternative Us

There are no restrictions on funding betting accounts using entropay so long as gambling is legal in the country you are currently in. Entropay is particularly useful if you are based in a country where online gambling is legal but your bank account is based in a country where it is illegal, or if your primary payment method does not allow this type of funding (e.g. American Express). Entropay allows you to load funds onto your prepaid VISA and then use the card for whatever transactions you like.

Remember whatever payment method you use if it is not legal to gamble online in the country you are currently in then you cannot legally fund betting sites.

The major advantageous feature of using entropay is the ability to keep all off your betting transactions in one place. This allows you to track winnings and loses while also preventing you from depositing more than you have in your account at any one time. The only transactions that will show up on your physical bank account are only those to and from entropay, it is only from within your entropay account would you be able to see any transactions to and from your bookmakers.

Of course you can also use your entropay VISA to pay for any other online services that you want to use.

Entropay Sign Up Bonus and Free Bets

Entropay is an excellent alternative to online eWallets such as Skrill, Neteller and PaySafeCard. Previous abuses and historical fraud associated with these payment methods have led to many online bookies removing their sign up bonuses for customers who sign up that way. This is not the case with entropay. All the betting sites listed in the table on this page will allow you to take the welcome bonus or free bet when you open an account and fund it using entropay.

How To Bet Using entropay

Entropay Customer Service Phone Number

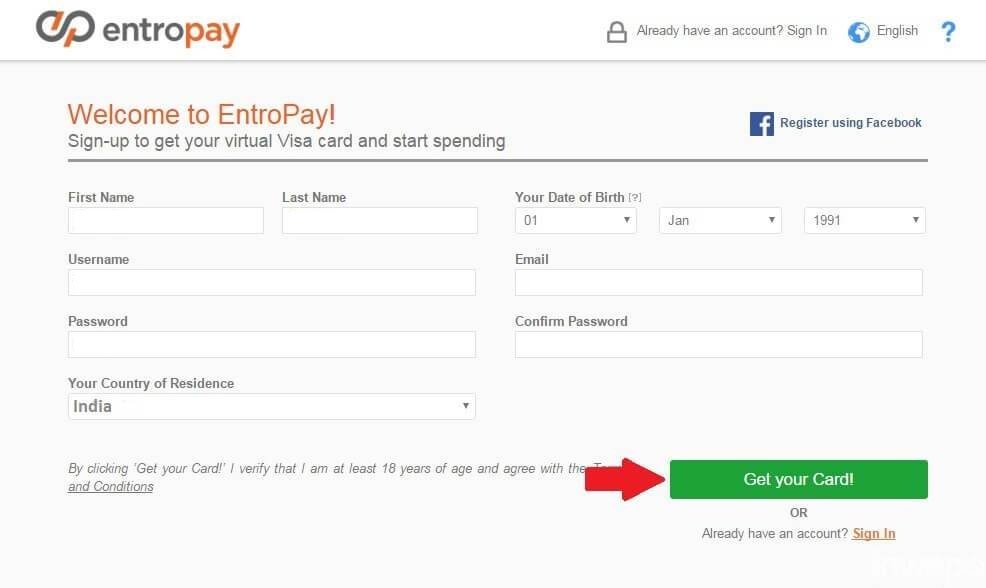

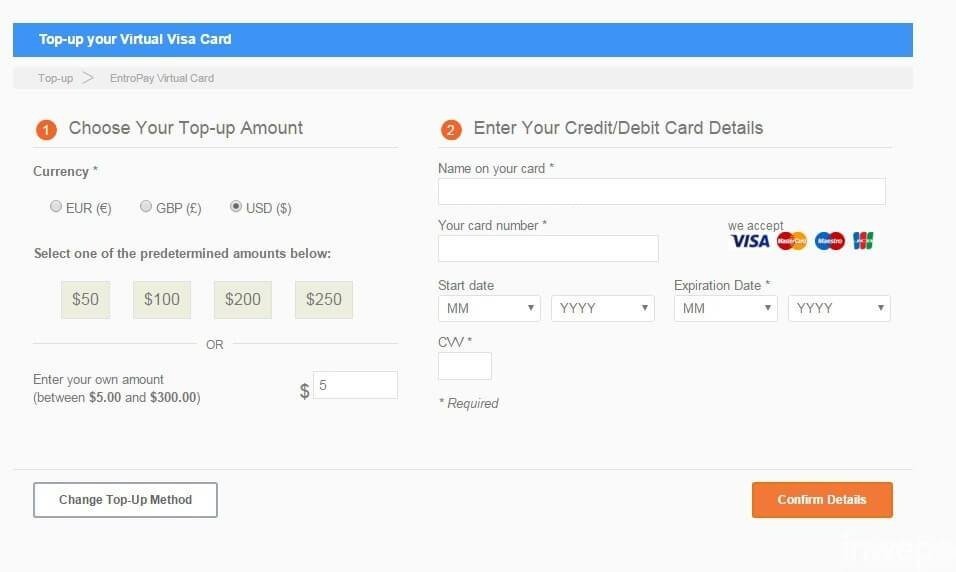

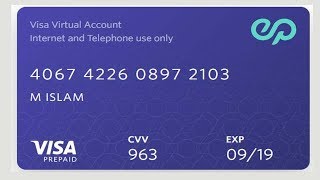

The entropay system is one of the simplest payment methods to set up and use. Sign up for an account in a matter of minutes, load the account with funds from your existing bank card or account and you can start using the service immediately. As this is a virtual card as soon as you sign up your 16-digit card number, expiry and CVV number is emailed straight to you allowing you to use your card immediately. As this is a pre-paid card there are no credit checks to go through from entropay either. You do still need to verify your age and location with the bookmaker as you would do with all payment methods.

Everything from here on in is just like using your normal bank card. As with all bank card transactions deposits to bookies are instant but there is also a time advantage when it comes with withdrawal with some bookies. Of course when you then withdraw from your entropay account back to your bank you will need to wait for the usual processing time.

Entropay are after all a business and so you do need to pay some transaction fees (you can read about these further down). These are fees for transacting with entropay, there should be no additional fees to pay with the bookmaker directly. If there are fees charged by your bookmaker for using entropay then go bet with someone who doesn't charge fees, it really isn't on. The entropay fees are similar to those you would pay with other similar services such as Skrill. What you get for paying fees is one of the safest and most secure means of gambling online (see security).

Alternative to a Bank Card or Transfer

The entropay system is absolutely perfect for anyone who wants to keep their betting transactions separate from the weekly groceries. Often when betting straight from your bank account it easy to lose track of how much you have deposited or withdrawn, the transactions are also visible by your bank and anyone else who has access to the account. If however you use a entropay account exclusively to fund your bookmakers wallet then you can not only keep abreast of your winnings more accurately you can also keep your gambling transactions private.

The other major benefit is the enhanced security compared to a traditional bank card. With entropay you only share your bank details with them not the bookmaker. Even if the bookmaker gets hacked and all your payment details are stolen any criminal could only access the funds in your entropay account, they would not be able to have access to your bank, credit card or any overdraft facilities.

Entropay will also let you have an unlimited number of cards, and allow you to set individual limits for those cards. This allows you to use one card for each site you bet with, giving not only added security but allowing you to keep better track of transactions and performance with individual bookmakers.

Countries Where entropay Can Be Used For Gambling

Being basically a virtual bank card you can use your entropay card to fund a betting account in any country where online gambling is legal. It is up to you to check if this is the case in the territory you live or are currently residing in. If you live in the USA for example it is illegal to fund an online betting account from within the country irrespective of if you are a citizen or use an account of a country where gambling is legal.

Conversely if you are say a US citizen with a US bank account but you are living in the UK, for example, it is perfectly legal for you to bet with an Online bookmaker. Your US bank account may restrict you from funding the account directly, this is a prime example of where entropay could be used an intermediate source.

Entropay do not allow bank transfers from any of the following countries, irrespective of whether you use the funds to gamble or not:

Afghanista, Belarus, Cote D’Ivoire, Cuba, Iran, Iraq, Lao, Liberia, Libya, Myanmar, Nauru, North Korea, Pakistan, Palestine Territory, Principe, Sao Tome, Sudan, Syria, Turkmenistan, Turkey, Uzbekistan, Yemen, South Africa.

entropay Security

Entropay Virtual Card

This is the absolute stand out feature of entropay. By not needing to share your bank or bank card details with multiple operators you are already more secure. You only need to share you bank details with entropay and you then use your 16 digit virtual card number direct with the betting site. This gives hackers and criminals less opportunity to get hold of your details. Entropay also have much stronger 128bit encryption compared to bookmakers themselves and this means even if someone was monitoring your transactions the data would be unreadable.

Entropay cards themselves are generated using cryptographic military-level security. They claim that no other pre-paid card has this level of security currently in Europe. Entropay themselves do not even know your username and password, this means that even an unscrupulous employee couldn't abuse the system.

Fees

There are fees to pay when loading funds into your entropay account and when withdrawing back to your bank account. This is common for all services of this type and the fee levels are comparable with services such as PayPal, Skrill and PaySafeCard. You should not need to pay fees to the bookmaker directly to use entropay as a payment method.

Below is the entropay fee structure, sending money from your entropay account is free, the account is also free to open and there are no fees for closing an account.

Entropay Alternative Australia

- Fund an EntroPay using a credit or debit card - 1% (EU) 4.95% (ROTW)

- Receiving money from a merchant - up to 1.95%

- Foreign exchange fee - 2%

- Withdrawing back to credit or debit card - £3 / $6 / €4.50